Last modified: March 14, 2025

Sales tax & resale tax exemption

How sales tax is calculated

Sales tax is charged and collected on all taxable items. When applicable, sales tax is estimated on the checkout page before you place your order based on the delivery/shipping address.

We use a third-party tax service to calculate sales tax on eligible purchases. This service uses tax rates from jurisdictions across the United States and information about the items, such as product category codes, that are taxable in each jurisdiction to generate sales tax estimates.

Submitting resale/exemption certificates for sales tax exemption

To exempt your purchases from applicable sales tax, you must provide us with a valid resale tax exemption certificate before you place an order.

To create and upload a tax exemption certificate:

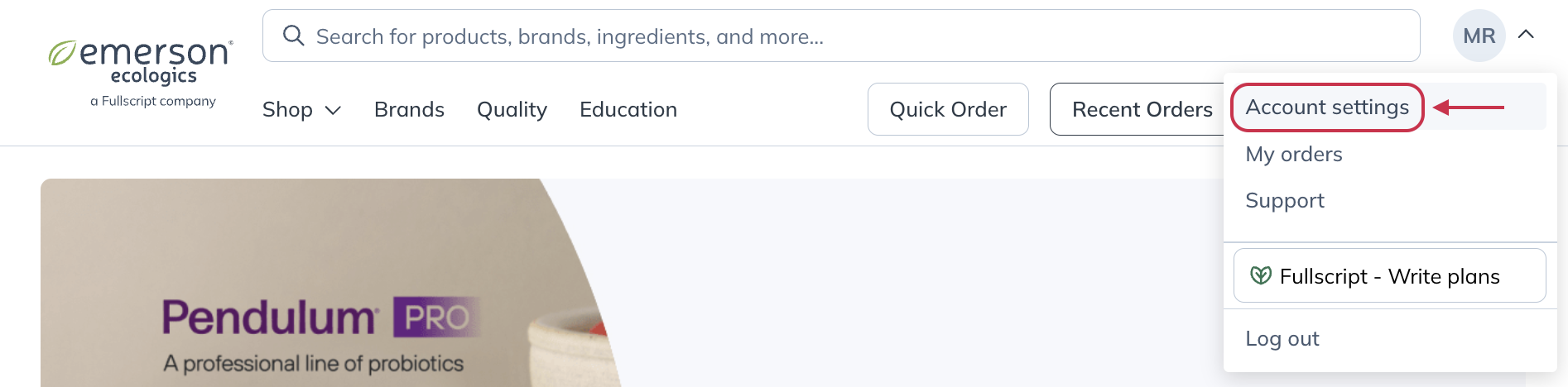

- Click your avatar or initials in the upper right corner of your account.

- Click Account settings.

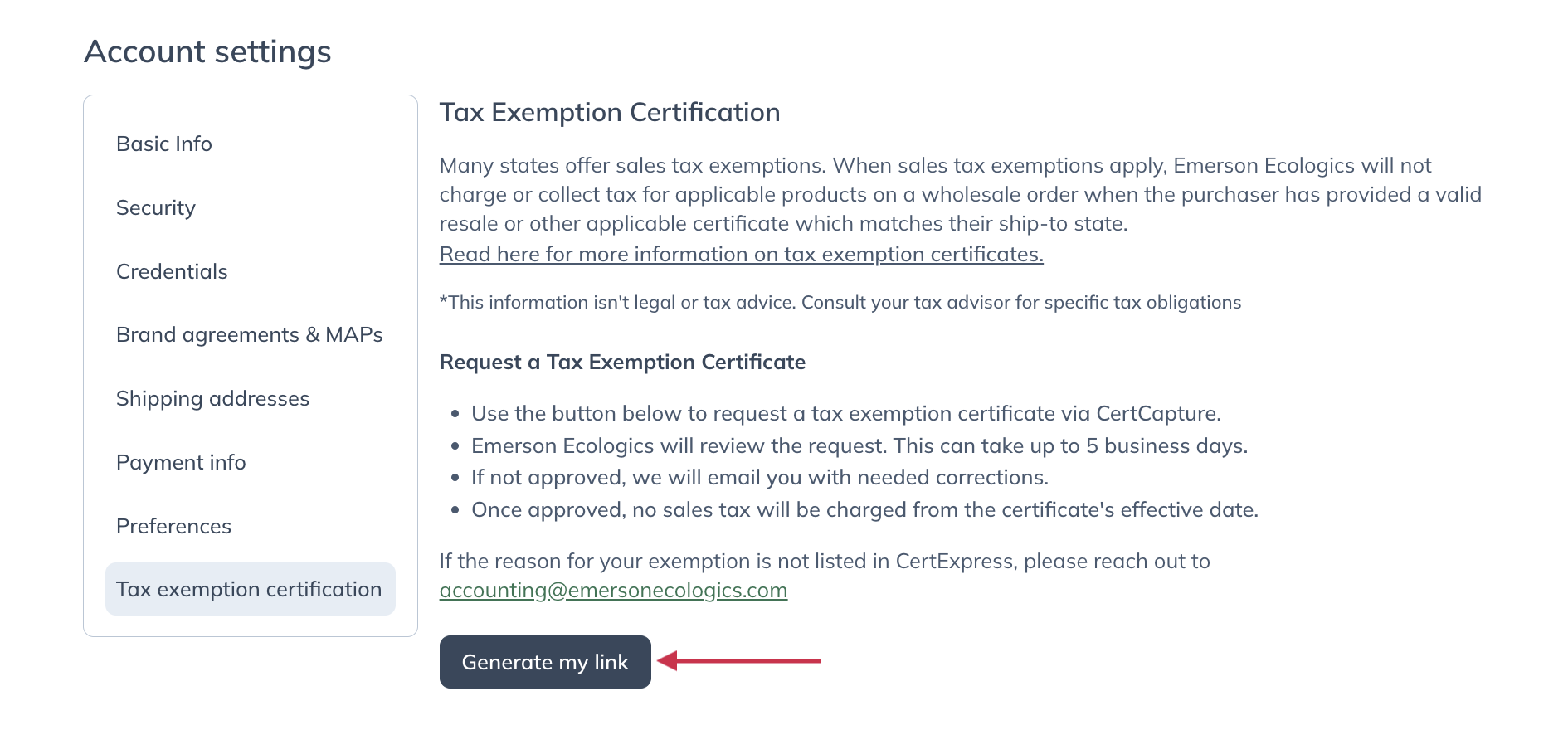

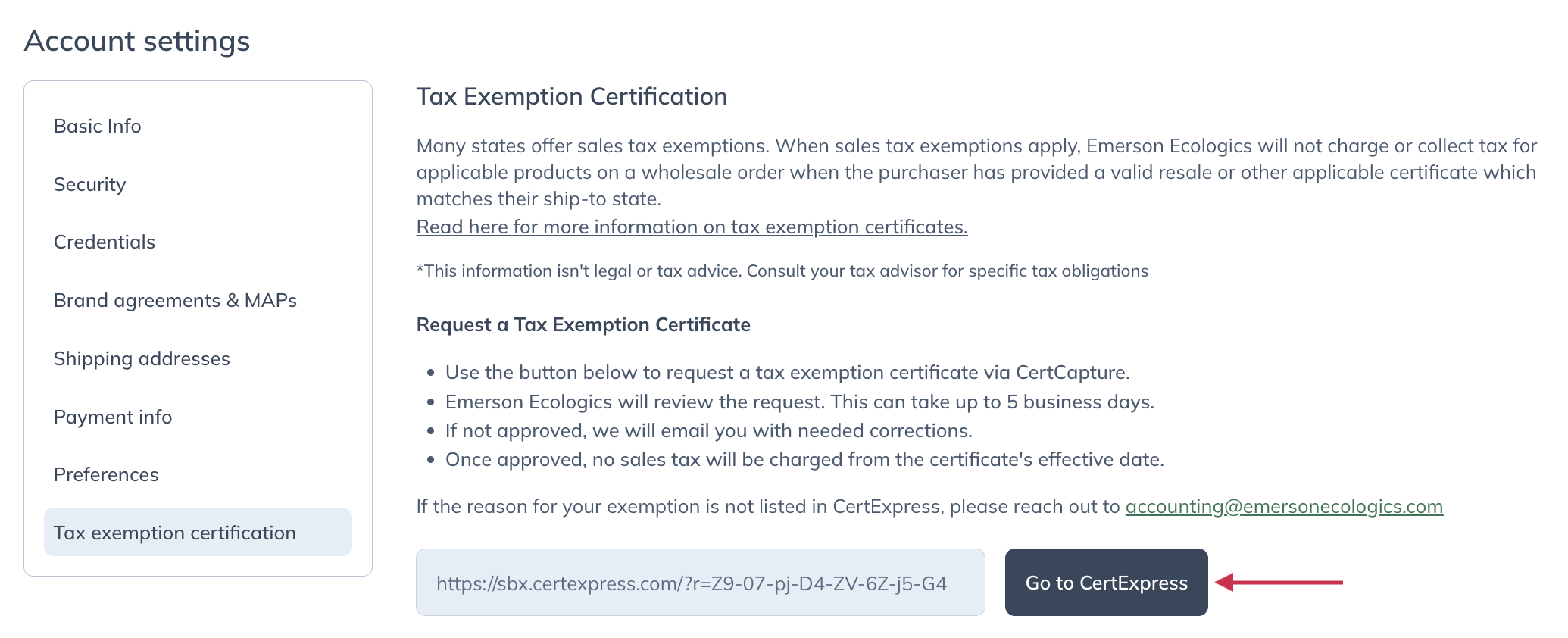

- In the navigation on the left of your Account settings page, click Tax exemption certification.

- Click the Generate my link button.

- When your link generates, select Go to Avalara. You’ll be taken to CertExpress in a new tab to complete your exemption request.

Submitting an exemption request

Tax exemption requests are submitted in CertExpress. It may take up to 5 business days for our Finance team to review and approve submissions.

To submit a tax exemption request in CertExpress:

- Review and accept the terms and conditions to access CertExpress.

- Select + Add an exemption certificate

- From the State or Territory menu, select the first ship-to state you’re claiming an exemption for. This selection will determine which information you will need to provide to complete the document.

- For Reason, select Resale.

- Click Next.

- Complete the required fields. These fields may vary by document, which is based on the state selected in an earlier step.

- Click Next.

- Enter your name, title (i.e., Dr., Ms., Mr, etc.) and provide your digital signature. To sign, place your cursor in the box then click, hold, and drag to draw on the page.

- Select Next to submit your form.

Multi-jurisdiction submissions

The US MTC Uniform Sales & Use Tax Exemption/Resale certificate – Multijurisdiction document is a blanket resale certificate covering a number of states. When presented with this document, users can select all states where a resale certificate is held to submit multiple requests simultaneously. A permit or ID number will be required for each state selected.

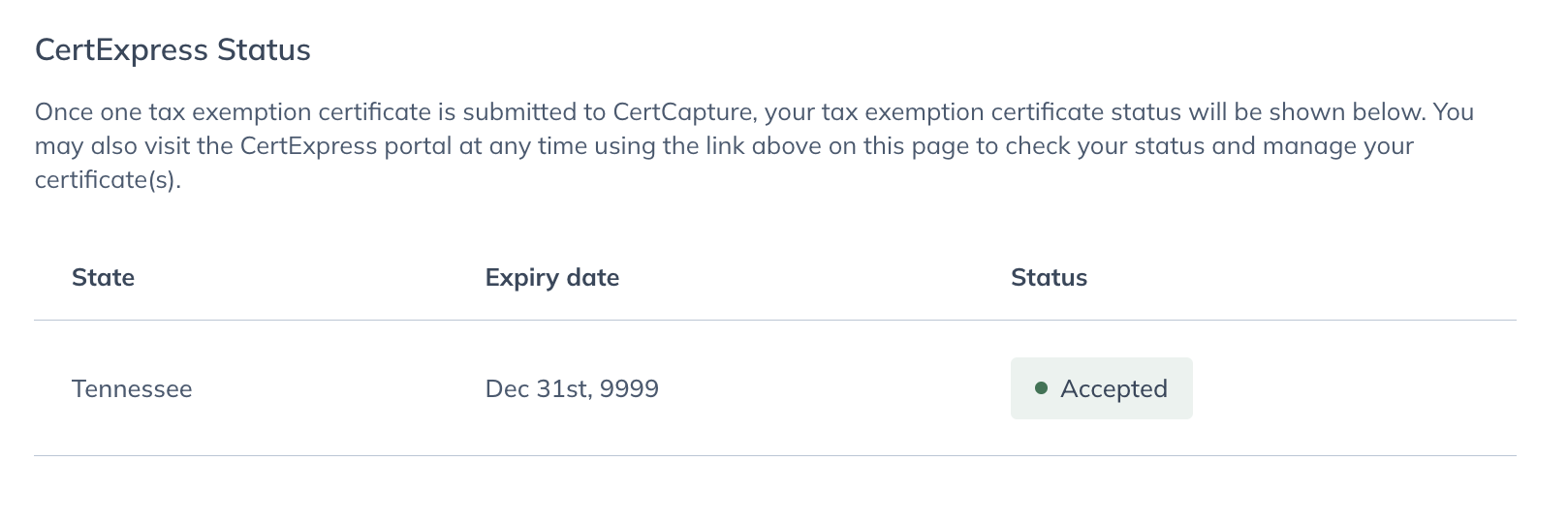

When completed, the Tax exemption certification tab in Account settings will show your exemption status for each state and permit/ID number entered under the CertExpress Status heading. It may take a few minutes for submissions to reflect in your account.

Exemption review & statuses

When your document is submitted in CertExpress, our Finance team will review and approve your request so long as your resale certificate details are valid. This may take up to 5 business days.

You can monitor the status of your request at any time from the Tax exemption certification page beneath the CertExpress Status heading.

Viewing the status of an exemption request on the Tax exemption certification page.

- Accepted: Your certificate was reviewed, approved and you will receive a follow-up email!

- Processing: Your certificate is awaiting approval from our Finance team.

- Expired: Your certificate has expired. We require a valid certificate.

- Denied: Your certificate has been rejected and you should receive a follow-up email from us explaining what steps to take next.

Certificate expiration and renewal

Sales tax exemption certifications expire periodically and must be updated. Validity periods vary by state. We’ll email you when your certification is nearing expiration.

To upload a new tax exemption certificate:

- Click your avatar or initials in the upper right corner of your account.

- Click Account settings.

- In the navigation on the left of your Account settings page, click Tax exemption certification.

- Click the Go to CertExpress button.

- Click + Add an exemption certificate and complete the form. Our Finance team will review and approve your resale certificate. This may take up to 5 business days.

You can monitor the status of your request at any time from the Tax exemption certification page beneath the CertExpress Status heading.

Alabama’s simplified sellers use tax (SSUT)

The State of Alabama created the simplified sellers use tax program (SSUT) under Statute § 40-23-192. We’re required to provide the following statement under the SSUT:

Seller has collected the simplified sellers use tax on taxable transactions delivered into Alabama and the tax will be remitted on the customer’s behalf to the Alabama Department of Revenue. Seller’s program account number is SSU-R010208370.